Tuition Relief Amid Coronavirus

May 16, 2020

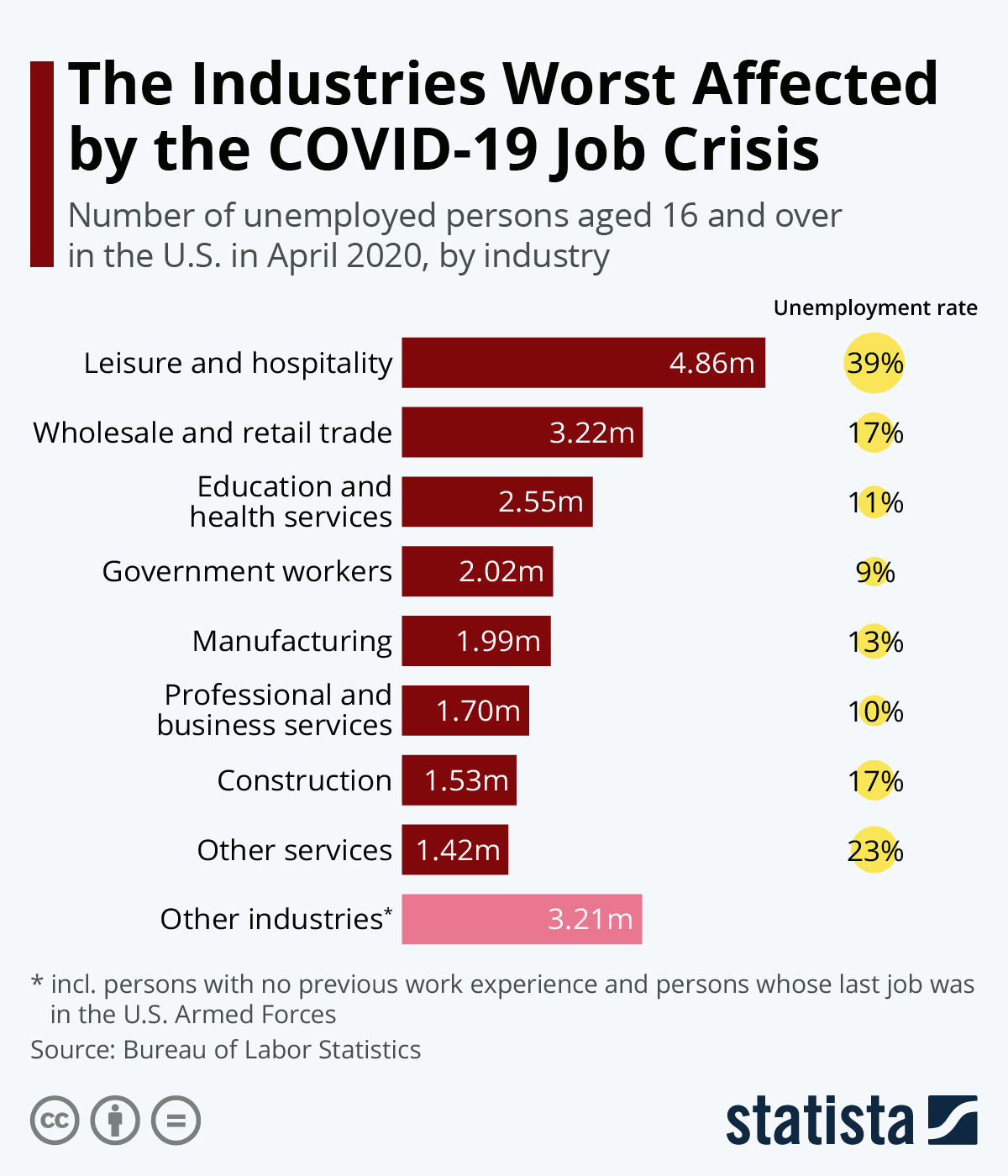

In the past eight weeks, 36.5 million Americans have been forced to file for unemployment. As of May 7th, the unemployment rate jumped to 14.7%, the largest rise in such a period of time (from mid-March) since such data tracking began in 1939. The stock market is as volatile as it has ever been. As experts are hesitant to recommend a reopening of the economy before adequate test-and-trace measures are implemented, the ominous-at-best financial effects of coronavirus will continue to persist for millions of Americans.

On April 13th, Stephanie S. Cordle of the St. Louis Post-Dispatch reported that MICDS has lowered their tuition for the 2020-2021 school year by $2,000 universally in response to the coronavirus pandemic. According to Cordle, MICDS’ tuition for middle and high school is $29,040, with one in every four students currently receiving some form of financial aid. In addition, each student will receive a $300 tuition refund insurance policy covered by the school, and the $300 charge for paying tuition over 10 installments has been eliminated as well. Tuition aid packages are expected to increase, and the school is actively promoting its new “Ram Relief Fund”, a donor fund created for families in need of monetary assistance greater than $2,000. The same benefits will be given to MICDS’ lower school, where tuition is $21,160. In reaction to the announcement, MICDS senior class president-elect Riley Clinton ‘21 stated, “I think this has been a great move by the administration and the board of MICDS…I think the “higher ups” are doing a great job of alleviating the stress of those families who are going through a tough time financially right now.” All in all, head of school Jay Rainey estimates that the adjustments made will cost nearest to $3.9 million. This measure is only set in place for the 2020-21 school year, all tuition and charges will return to its usual rate for the 2021-22 school year. MICDS is the only school in the state to implement a universal measure.

In a “Friday Update” email delivered to the JBS community on April 10th, head of school Andy Abbott stated, “Our goal as a school is to make sure that every member of the community who wants to stay at Burroughs is able to do so.” Mr. Abbott invited “anyone who is concerned about their family’s ability to meet their financial obligation to Burroughs due to new financial issues created by the current crisis to reach out” to the school’s business manager, Laura Placio. Abbott accredits this approach with preventing any members of the JBS community from having to leave the school due to finances during the 2008 financial crisis. According to the Burroughs website, tuition for the 2020-2021 school year is $30,300, $1,260 more than MICDS’ middle and high school tuition (Neither totals include additional payments for textbooks and supplemental classroom materials). Burroughs charges families who elect for a ten installment tuition payment plan $15 per year compared to MICDS’ usual $300. Burroughs’ fee isn’t expected to change. Both school’s websites claim that 24% of their student body already receives some form of tuition assistance.

Considering all possibilities of tuition relief, what is Burroughs’ ability to allocate its funds to the student body? This financial crisis not only affects the student body, but also the school severely. In any measure, this endeavor would be costly. Rainey’s $3.9 million estimate for MICDS’ aid package accounts for its 1,234 total students (from 2018-2019 MICDS school profile), just less than double Burroughs’ 641 total students currently. One’s perception might be that as Burroughs has less students, a universal plan would be less expensive, thus an easier venture overall. However, a greater student body implies an exorbitantly greater pool of alumni and families of the school, which can make it much easier to obtain endowment funds and annual giving over time. Per MICDS’ website, “We celebrate the support of parents, alumni, grandparents, parents of alumni and faculty and staff whose high participation rates combine to make a significant impact on our students. Last year (2018-2019 school year), over 2,450 individuals gave $1,637,234 to the MICDS Fund.” A January 2018 Post Dispatch Article placed MICDS’ endowment at more than $115 million.

Considering all possibilities of tuition relief, what is Burroughs’ ability to allocate its funds to the student body? This financial crisis not only affects the student body, but also the school severely. In any measure, this endeavor would be costly. Rainey’s $3.9 million estimate for MICDS’ aid package accounts for its 1,234 total students (from 2018-2019 MICDS school profile), just less than double Burroughs’ 641 total students currently. One’s perception might be that as Burroughs has less students, a universal plan would be less expensive, thus an easier venture overall. However, a greater student body implies an exorbitantly greater pool of alumni and families of the school, which can make it much easier to obtain endowment funds and annual giving over time. Per MICDS’ website, “We celebrate the support of parents, alumni, grandparents, parents of alumni and faculty and staff whose high participation rates combine to make a significant impact on our students. Last year (2018-2019 school year), over 2,450 individuals gave $1,637,234 to the MICDS Fund.” A January 2018 Post Dispatch Article placed MICDS’ endowment at more than $115 million.

Regardless, a large stake in Burroughs’ funding will be required, which would add to the $3,791,418 in tuition aid that will be granted to 25% of the student body (165 students) for the 2020-21 school year. “And now, we have already gone over that budget by more than $200,000 and know requests for tuition aid and new payment plans will likely increase significantly due to families experiencing job and income loss,” Abbott said. The tuition aid total will be increased by nearly $275,000 for this next school year due. The school’s operating budget for this school year rests at $22,950,800. According to Burroughs’ 2018-2019 annual report, 78.9% of Burroughs’ incomes comes from its tuition, 18.7% comes from the school’s annual and endowment funds, and the remaining 2.2% comprises capital gifts which automatically go to athletic enhancements, campaigns for Burroughs, and the newly constructed STAR building. Burroughs uses its income to pay faculty and staff salaries, plant operations, utilities, insurance, and repairs. Due to all changes in response to Covid-19, Burroughs has saved money in the costs that come with SAGE dining, travel costs to outside events, and plant operations (heat, light, power). However, these gains serve as a fraction of the school’s total losses. Any other form of relief has to come from the school’s endowment, a fund valued at $54,650,017 as of May 31st, 2019, but has not fared well as of recent. Mr. Abbott states that “the school has lost about $9 million from our endowment, due to the drop in the stock market, which will ultimately cost us a great deal of money as we rely on interest income from the endowment for almost 10% of the operating budget.” Endowment giving can come in many forms, and one way is through stock. Any form of donated stock is surely of lesser value than it was at the time of giving, and by many projections will continue to decrease over time. Moreover, endowment donations of any method often have restrictions on their usage, similar to capital campaign funds. A study in the Voluntary Support of Education Key Findings deduced that 85% of endowed gifts to schools were restricted, and by law, schools must abide by these restrictions. As of March 31st, Burroughs’ endowment rested at $44.8 million, with approximately $8 million of the total defined as unrestricted. Schools can also use their endowment’s interest without restrictions, and in Burroughs’ case for the operating budget.

Funds obtained from Burroughs’ annual giving have seemed to drop due to the economic hardship: “Right now, we are about $200,000 behind where we typically are at this time of year,” said Abbott. Other forms of income, most notably from summer camps are almost completely lost. Six weeks of Burr Oak has been cancelled ($475 a session per camper, not including $75/$150 extended day fees) as the school has postponed summer activities on campus until August. Bomber Sports Camp is still hoping that they can host their week of camp the first week in August ($350 a session per camper).

Burroughs qualified for and received a $2.55 million loan from the Paycheck Protection Program (PPP), but followed the directive of Treasury Secretary, Steve Mnuchin to return the loan. MICDS also received and returned a loan from the PPP. The loan would have been the first time the school received financial aid from the federal government in its ninety-seven year history. Before the loan’s return Abbott attributed, “Burroughs has more than 200 employees, and with the help of the Federal loan, we will not have to furlough any of them.” In his most recent Friday Update, Mr. Abbott stated that retaining all faculty is still of the utmost importance, even with the loan’s return. Regardless, the loan shows the strain that even prestigious private high schools are currently under.

According to Burroughs’ 2018-2019 annual report, 78.9% of Burroughs’ incomes comes from its tuition, 18.7% comes from the school’s annual and endowment funds, and the remaining 2.2% comprises capital gifts which automatically go to athletic enhancements, campaigns for Burroughs, and the newly constructed STAR building.

All things considered, all decisions regarding tuition require Burroughs to strike a balance between educational equity, equality, and financial sustainability. The school has and will continue to see an increase in both families requesting tuition aid as well as the total amount needed to give in relief. If the school increases the sum of money it offers in relief to all of its students, invariably, any extra amount they could offer to those who need relief the most will decrease. According to the school’s website, Burroughs never treats two families’ economic situations the same, and this practice is expected to continue. Burroughs will also have to answer the call for relief under a far more severe economic situation in their own right. The full economic implications of coronavirus are still unknown and will undoubtedly last longer than our time in quarantine. Abbott concludes, “we remain committed to our guiding principles: keeping our program as strong as always, supporting every student and family to ensure they can return to Burroughs and retaining our remarkable faculty and staff.”