NYT Report Highlight President’s Tax Avoidance

November 2, 2020

In September, The New York Times published an exposé revealing that President Donald Trump paid no federal income taxes in ten of the last fifteen years, in large part because he reported losing more money than he made. Amidst unfavorable polling, the Coronavirus pandemic, an economic recession, and protests across the nation, President Trump received backlash among Democrats after The Times revealed that he paid only $750 in federal income taxes when he was elected, and another $750 in his first year in the White House. Burroughs students have reacted to the news with frustration, though most students have already decided whether or not they approve of the President.

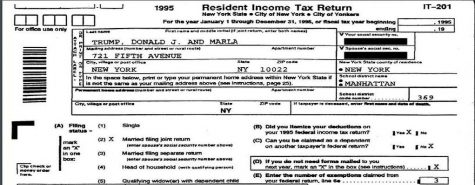

The Times published a 10,000-word report and analysis of President Trump’s tax returns extending over two decades, “revealing struggling properties, vast write-offs, an audit battle and hundreds of millions of debt coming due.” The documents of Trump’s tax returns have long been sought after, as he is the first President in modern history to refuse making them public. Times reporters Russ Buettner, Susanne Craig and Mike McIntire said they attained the documents legally, though Trump and his lawyers refute that statement. The numbers in these documents were reported by President Trump (not an independent body) to the Internal Revenue Service (IRS).“Ultimately, Mr. Trump has been more successful playing a business mogul than being one in real life,” writes the Times reporters. While his reality TV show “The Apprentice” and his licensing and endorsement deals brought him a quick $427.4 million, this profit was rapidly spent on his famous business ventures, like golf courses and hotels. These Trump-branded sites frequently devoured more cash than they generated, allowing Trump to pay fewer taxes. “In many years, Trump lost more money than nearly any other individual taxpayer,” wrote the Times exposé.

The amount he paid in taxes was also reduced because spending towards his lavish lifestyle is classified under the cost of running a business. For example, Trump received a $70,000 deduction for his television hairstyling. Ivanka Trump, the President’s daughter and employee of the Trump Organization, also accepted “consulting fees” that reduced Trump’s tax bill.

President Trump’s tax returns also reveal an IRS audit battle over a 72.9-million-dollar tax refund, and a loss would cost over $100 million. In addition, Mr. Trump has $300 million due in the next four years, raising questions about the potential conflict of interest should he be re-elected in November. It is unclear if the government could, or should, foreclose on a sitting president. Every president since Jimmy Carter has made their taxes public until Mr. Trump. There’s no law requiring this information to be public, but it’s recently been used to build trust with the American public. Trump has previously danced around the question of disclosing his tax returns and bragged of taking advantage of tax loopholes, saying that it “makes [him] smart.”

The effect this news will have on the election is unclear. There is a large amount of evidence that Trump’s personality as a businessman played a large role in his election in 2016. According to a Gallup poll in 2016, voters saw Trump’s experience as a businessman as the second most important factor for their support– second only to his status as a non-politician and outsider.

In the 2016 Presidential Election exit poll, 48 percent of voters said Trump would better handle the economy, compared to 46 percent for Clinton. His approval rating on the economy is consistently higher than that of other issues like education, foreign policy, and crime.T

rump’s image as a great dealmaker is essential to his political brand, and his tax records may potentially jeopardize this. The Trump campaign is already struggling to curtail criticism of its handling of the coronavirus pandemic as well as the social unrest this summer. Early voting has already begun in many states, leaving little time for him to turn his ratings around. Democratic Presidential candidate Joe Biden is utilizing Trump’s taxes as evidence of Trump’s betrayal of the working-class voters the President promised to fight for. Meanwhile, former Vice President Biden is attempting to underscore his own middle-class upbringing in Scranton, Pennsylvania.

“Not paying taxes and avoiding rules blatantly disrespects the people living in this country,” says Burroughs student Summer Levin (‘24). For Levin, Trump’s tax evasion is just another sign of failure from the president.

“When I heard the news I obviously wasn’t very happy, as the famous billionaire turned president pays less taxes than my family,” said Gaurav Muthusamy (‘22), who supports Trump for re-election. For Muthusamy, Trump is another example of the rich using loopholes to pay less, and although the president may not be the wealthiest businessman, his success in Hollywood is “still impressive.” “It doesn’t really change his image for me,” adds Muthusamy. “The moment he declined sharing his tax returns in 2016, I knew he likely paid less.” Many stories surrounding Trump and his re-election campaign receive mixed opinions, and reactions often fall along party lines. Legal or illegal, right or wrong, Americans have varied opinions on the Trump presidency.